5 Finance KPI Dashboards & Why Financial Ratio Analysis is Critical

Vikram Agnihotri, Senior Solutions Engineer

August 3, 2023

NaN minute read

Key takeaways from this article:

You can answer the goals of a business with financial KPIs

You should use modern BI tools, not spreadsheets, to make it easier to track KPIs and explore the causes of any anomalies

You can duplicate the self-serve dashboards we built below for your company's financial ratio analyses in Mode

Why financial KPI tracking is critical

Financial KPIs are some of the most critical metrics that determine business performance. As your business leaders align their organizations towards a purely results-oriented culture, it becomes even more pertinent to measure if the efforts are enabling the organization’s trajectory to move upwards and beyond.

CFOs drive the business ahead by ensuring that the products and projects an organization invests in yield a positive ROI. Financial key performance indicators equip them with a quick glimpse into business performance with a bird’s eye view of what is working and what needs to be delved into deeper.

The organizations that do not track their performance against set goals are unable to gauge their trajectory and might significantly arrest their top and bottom-line growth.

Financial KPIs help clarify your company's foundational goals

The growth trajectory of every business is governed by answers to these three fundamental questions:

Why do we exist?

How do we achieve our goals?

What actions do we take to achieve our goals?

The above paradigm was introduced by Simon Sinek in his book, “Start With Why.” Let's briefly discuss these and how they tie back to business health KPIs:

Every business starts with “Why do we exist?”. The answer to this question drives the overarching goals of the business and constitutes the pertinent customer issues that the products or services of an organization would resolve.

Once the goals are established, the business needs to answer, “How are we going to achieve the why?”. And the answer to this question lays the foundation of the processes and principles that act as a guide to achieving the business goals.

After establishing the ground rules, the business decides, “What actions need to be taken?” The actions include the products and services that the organization offers to achieve the goals established under the guidance of the processes and principles envisioned.

The framework mentioned above is great, but how do organizations perceive:

The success of their products and services—the “What” part?

And that their principles—the “How” part—are ushering them on a successful path to achieve the goals set—the “Why?”.

That’s exactly where KPIs come in. A company’s KPIs quickly provide insights into how the business is performing and if it is on track with its plans.

Organizations are driven by multiple lines of business such as sales, marketing, finance, product, customer service, supply chain, and many more.

Like a complex rocketship, where each component has its specific function and must operate at its peak performance, each team defines its own success criteria with a set of KPIs. In this article, we'll focus on the finance function that enables the organization with the resources (money) to run the business (the rocketship) and ensures that it's moving in the right direction and doesn’t run out of fuel (money) during its journey.

Why financial ratio analysis is critical

Financial ratios help unlock insights into whether the organization’s business is thriving and worth investing in. These ratios are leveraged internally by the finance team, C-Suite, and analysts (who provide business insights and recommendations to invest in businesses) who can utilize this ratio analysis to steer the rocketship into an upward trajectory and also identify and mitigate risks in the growth journey.

The financial analysts outside the ambit of the organization leverage these metrics as well and highlight if the organization is ripe for investment and getting a stake in its growth.

Metrics Definition Template

A template for data teams and stakeholders to define metrics together.

5 Financial ratio analysis dashboards

There are five main categories under which the financial ratio KPIs can be grouped, and they provide a glimpse into the liquidity, leverage, efficiency, profitability, and market value position of an organization.

We’ve created a dashboard for each of these financial ratio categories to demonstrate how you could look at them in Mode. Because financial ratios need to be tracked over time, we have incorporated the performance of a public company dataset with a 5-year time horizon.

Duplicate these dashboards into your own Mode Workspace!

Sign up for a free version of Mode here. These dashboards will help you get glimpses of financial standing, compare these ratios with your competitors, get insights on places for improvement, and set targeted action plans.

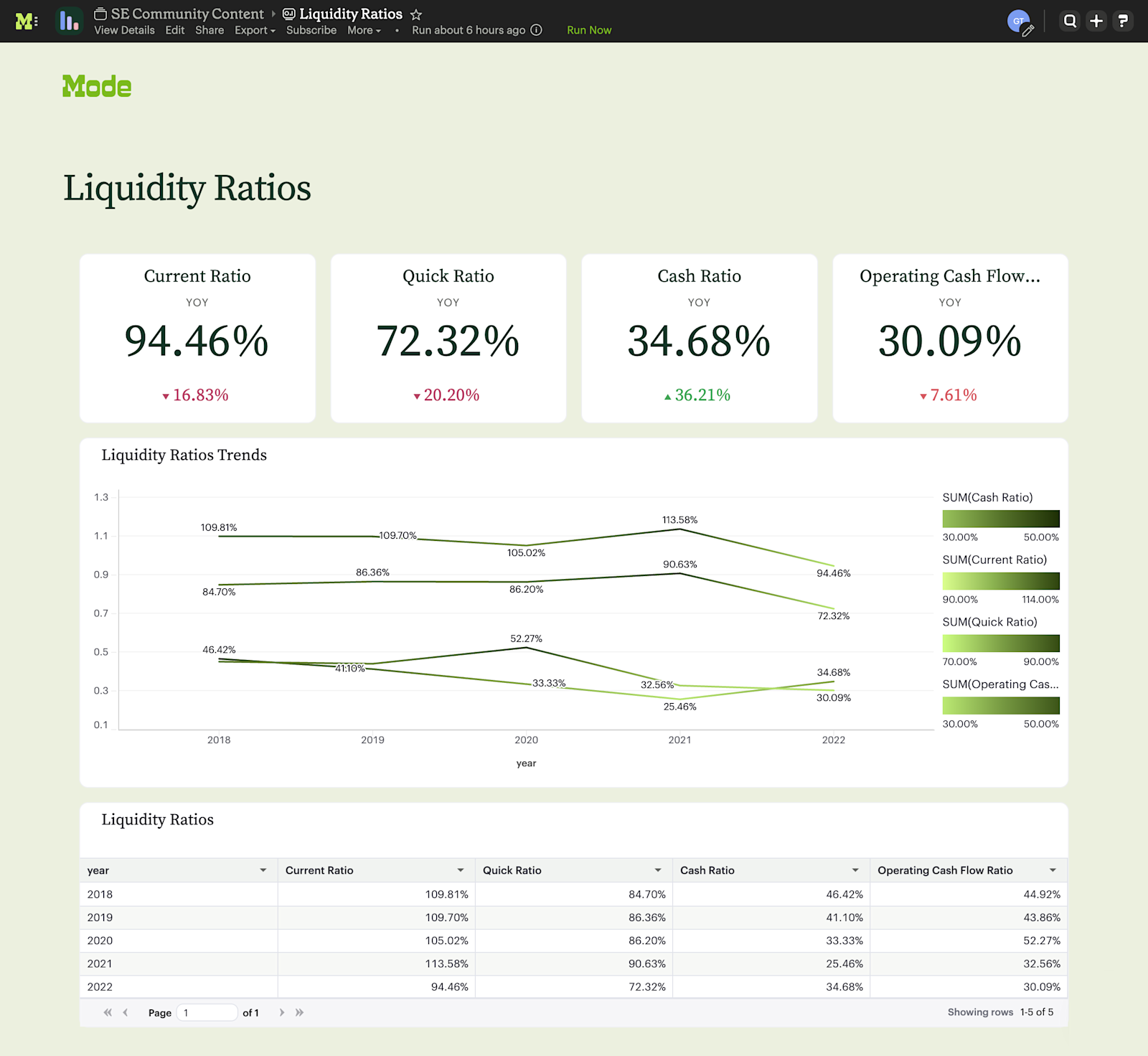

Liquidity Ratios

Current Ratio = Current Asset/Current Liabilities. (The current ratio is a liquidity ratio that measures a company’s ability to pay short-term obligations or those due within one year)

Quick Ratio = (Total Current Assets- Inventory -Prepaid Expenses)/Current Liabilities (The quick ratio is an indicator of a company’s short-term liquidity position and measures a company’s ability to meet its short-term obligations with its most liquid assets.)

Cash Ratio = Cash and Cash Equivalents/Current Liabilities. (The cash ratio is a measurement of a company's liquidity. It specifically calculates the ratio of a company's total cash and cash equivalents to its current liabilities.)

Leverage Ratios

Debt Ratio= Total Debt/Total Assets. (The term debt ratio refers to a financial ratio that measures the extent of a company’s leverage.)

Debt to Equity Ratio = Total Debt/ Total Equity. (The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company's economic health and if an investment is worthwhile or not.)

Interest Coverage Ratio = EBITDA/Interest Expense. (The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt.)

Debt to Assets Ratio= Total Debt/Total Assets

Debt Service Coverage Ratio = Net Operating Income/Total Debt Service. (The debt-service coverage ratio (DSCR) measures a firm's available cash flow to pay current debt obligations.)

Efficiency Ratios

Inventory Turnover Ratio = COGS/Average Inventory (Inventory turnover is a financial ratio showing how many times a company turned over its inventory relative to its cost of goods sold (COGS) in a given period)

Fixed Assets Turnover Ratio = Net Revenue/ Average Fixed Assets (This efficiency ratio compares net sales (income statement) to fixed assets (balance sheet) and measures a company's ability to generate net sales from its fixed-asset investments, namely property, plant, and equipment (PP&E).)

Asset Turnover Ratio= Net Revenue/ Total Assets (The asset turnover ratio measures the value of a company's sales or revenues relative to the value of its assets.)

Accounts Payable Turnover Ratio = Net Credit Purchases from Suppliers/Average Accounts Payable (The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers.)

Receivable Turnover Ratio = Net Credit Sales/ Average Accounts Receivable (The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance.)

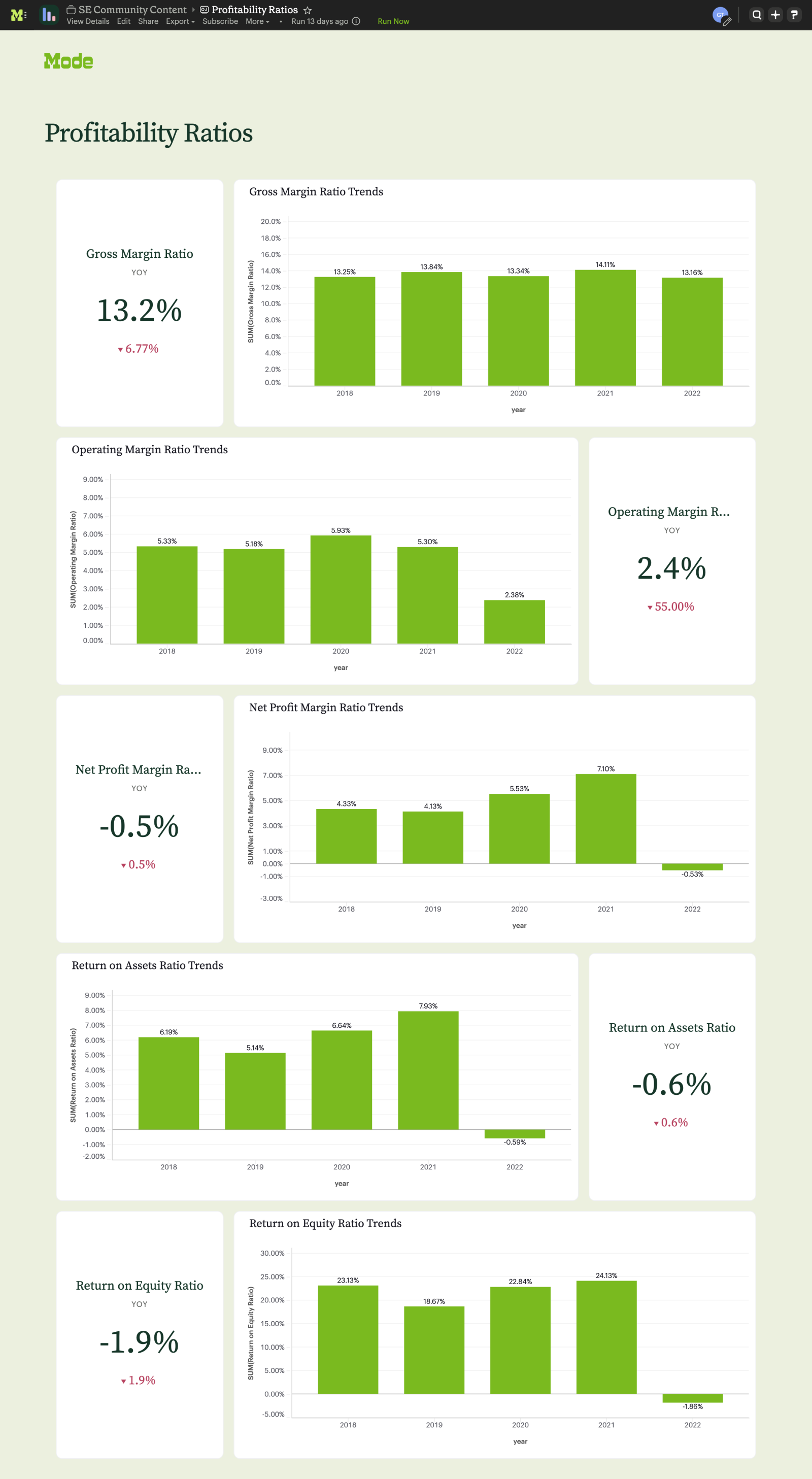

Profitability Ratios

Gross Margin Ratio = Net Sales -COGS/ Net Sales (A company's gross profit margin is the money it makes after accounting for the cost of doing business and the ratio is expressed as a percentage of sales)

Operating Margin Ratio= Operating Income/Net Sales (Operating margin indicates how much operating profit a company makes per dollar of sales. )

Net Profit Margin Ratio = Net Income/ Total Revenue (Net Profit Margin is expressed as a percentage and shows how much of each dollar collected by a company as revenue translates to profit.)

Return on Assets Ratio = Net Income/ Total Assets (Return on assets (ROA) is used in fundamental analysis to determine the profitability of a company in relation to its total assets.)

Return on Equity Ratio = Net Income/ Average Shareholders’ Equity (Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity.)

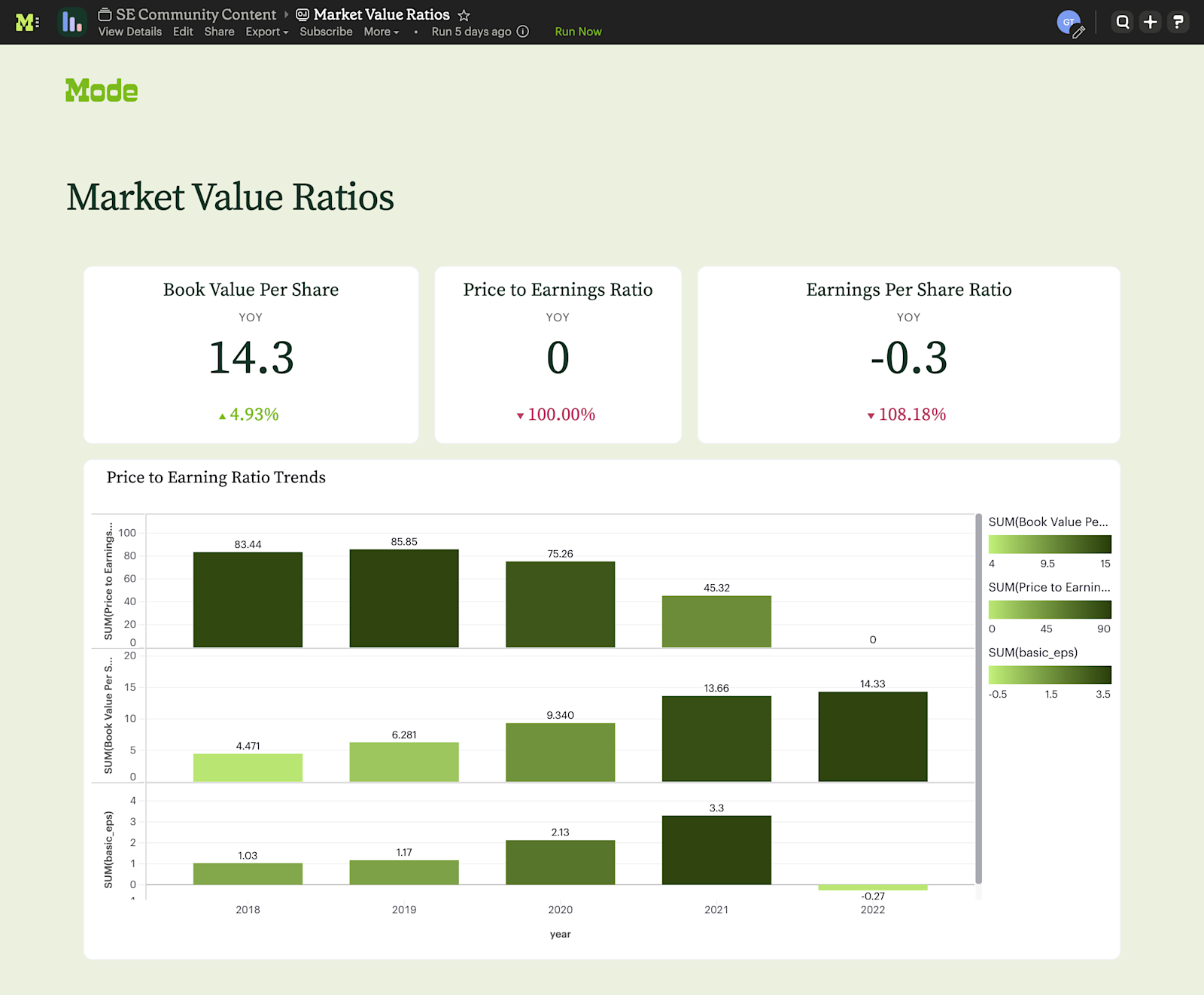

Market Value Ratios

Book Value per Share Ratio = (Total Equity- Preferred Equity)/Total outstanding Shares (Book value per common share (or, simply book value per share - BVPS) is a method to calculate the per-share book value of a company based on common shareholders' equity in the company)

Dividend Yield Ratio = Annual Dividend per Share/Price per Share (The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.)

Earnings per Share Ratio = Net Income - Preferred Dividends/ End-of-Period Common Shares Outstanding (Earnings per share (EPS) is a measure of a company's earnings per common share, prior to the conversion of any outstanding convertible securities.)

Price to Earnings Ratio = Market Value per share/ Earnings Per Share (Price-to-earnings ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

Now that we know what financial KPIs are and why they’re important for your business it’s important to understand how organizations can track these ratios.

Tracking financial KPIs—Spreadsheets vs. BI tools?

Spreadsheets

There are a plethora of ways to track financial KPIs. The legacy method was to build these ratios in spreadsheets, but this method only provides a glimpse of the topline ratios. Previously, finance leaders were devoid of being able to answer even the basic follow-up finance questions such as, “Why did the revenue get hit in a month?”.

To answer these basic “why” questions, finance leaders had to go back to the financial analysts who would sift through hordes of information to find the answers to the above question. And any subsequent follow-up ad hoc questions would result in even more wasted time from the data team.

BI tools

Agile organizations have adopted building BI dashboards by leveraging modern BI platforms. This is because interactive dashboards, like the ones above (click into the Mode report link to interact with them), enable answering “What has happened in the past?” by taking the underlying financial data and presenting the data as aggregated KPIs.

Additionally, modern BI dashboards let finance stakeholders (or any stakeholder with the right permissions) quickly answer ad hoc questions like, “Why did a particular KPI improve significantly or perform badly?”. Equipped with the requisite knowledge to these questions quickly, they can take appropriate actions quickly.

Setting up finance KPI dashboards in a BI tool

This blog post provides a bird’s eye view into how organizations that intend to move fast and outperform their competitors track their financial ratios. To set up their own financial KPI dashboards, analysts need to:

Build a pipeline with ETL tools to move all the financial data into a data warehouse for analysis.

Perform transformations and build balance sheets, income statements, and cash flow statements from underlying data from the warehouse. (This can be done with a transformation platform and a BI platform like Mode.)

Build calculated fields leveraging the measures of the above three financial statements and visualize the financial ratios in a self-serve dashboard.

Using Mode to track financial KPIs

A few ways how Mode can enable speed-to-insight for finance leaders and their teams.

1. Finance and data teams can collaborate in one tool

In Mode, the finance and data team can collaborate together to build dashboards in Mode and share them with other teams. These financial reporting dashboards can act as North Stars for finance leaders and their stakeholders to gauge how the business is performing.

2. Business users can explore the data further

In addition to the above, the business users of the Mode dashboards can leverage the Explore functionality from the charts of the dashboards. By digging into the data interactively they can get to the root cause of spikes and declines of various financial KPIs. Easy data exploration in Mode helps answer the question “Why did a particular phenomenon occur and how it affected the business?”

3. Forecasting becomes easier

Most BI tools stop at the second step, which makes it cumbersome to predict how the business will evolve and, thus, how the financial KPIs might look in the future. With Mode, an organization’s data science team can build future forecasts leveraging forecasting models such as ARIMA, SARIMA, TBATS, etc. easily, and predict how the financial KPIs will be impacted in the coming few months.

This helps anyone in your organization answer, “What do the future financial projections look like?” and enables planning and aligning an organization's resources preemptively. Also, instead of using multiple tools, Mode reports have an easy workflow from a SQL Editor to Python/R notebooks to BI visualizations in a single platform, saving a lot of context-switching time for data teams.

An example: See why cash conversion is taking a hit quickly in Mode

As finance leaders and their organizations continue to grow their data maturity, Mode enhances the capabilities to answer ad hoc business questions quickly.

Let's see an example of this in action.

While observing his North Star dashboard of financial metrics, the CFO of a company, Totals Package (made up name), finds that the cash conversion cycle (calculated by summation of Days Inventory Outstanding - DIO and Days Sales Outstanding - DSO and subtracting Days Payable Outstanding -DPO) of the organization is taking a hit. Let's see how fast the finance organization can take action on this observation:

The CFO explores the dashboard and drags and drops the DPO, DSO, and DIO metrics in his exploration and sees that the DPO has increased since the past quarter.

He shares this exploration with the finance lead and seeks his input on why the DPO has increased.

The Finance Lead intends to observe the data at a more granular level, and has just the right curated table called dataset to do so - which contains the payment terms of all the vendors. This dataset was built by the data team, who knew where the right data resides, and the Finance Lead, who provided domain understanding of what needs to be pulled.

The finance lead selects this data set and pulls it into the Mode report. He swifty builds filters on top of this, like Large, Medium, and small vendors and payment terms and brackets the payment terms into 30, 60, 90, and >90 brackets, and slowly, trends start to emerge.

He observes that payment terms have gradually increased for the large vendors since the past quarter. This resulted in an increase in the DPO. He shares these insights with the CFO, and they formulate a corrective action plan to arrest this change.

The above scenario highlights the future-ready robust finance functions and how they adapt and respond quickly to ad hoc questions from the stakeholders. This puts the CFO and the finance leads in the driver's seat, who, in addition to enabling bottom-line improvements, lead products and projects which have positive ROI and result in topline impact as well.

Conclusion: Financial KPIs are critical, Mode makes them easier to measure

The financial KPIs that you track may vary according to the industry type and the stage the business is in, but a modern BI platform, like Mode, can make it easier every step of the way. Request a demo of Mode or join Mode's live weekly group demo.

The 2023 Playbook for Early-Stage Data Leaders

Create a data program that scales.

Get our weekly data newsletter

Work-related distractions for data enthusiasts.